I was in my third trimester when a report came out stating that the average cost of raising a child was up to $245,000.

You read that right. $245,000.

I’ll give you a minute to let that sink in. Wipe the vomit from your chin.

Thank goodness we live in Kansas City! Where a four-bedroom, two-and-a-half bath home can cost $200,000, as opposed to $1,300,000 in California! Where gas prices average near $2.27 a gallon, as opposed to $3.23 or higher! Without a doubt, we live in a very comfortable and affordable place.

That being said, one cannister of my son’s hypoallergenic formula costs $29.99 and lasts approximately 5 days. Daycare for an infant can range anywhere from $175-325 a week. And I don’t even want to think about my son’s future braces, glasses, car and college fund. Or the prospect of adding another munchkin to our little family of three.

So, how are we supposed to do it? How do we raise a baby, or 2 or 3, knowing that each new life is going to add to our tab?

One word. Budget.

For me, “budget” isn’t a 4-letter word. In fact, it has become a bit of a game. How much can I save? Where can I find the best deal? Over the years, I’ve added many tips and tricks to my arsenal, and today I’m sharing a few of those with you.

Ready to get started? Review what you’re already spending.

The age of the interwebs has made this task incredibly easy! Bank accounts, credit cards, mortgages, and student loans will all allow you to log in to their websites to view your personal account. So, click on your browser of choice, log in to your accounts and get to reviewing. Where is your money going right now? Are you, like my family, spending an ungodly amount of money at Target? Feel free to dig a little deeper. How much do you spend on food? Baby items? Gas? Coffee? Netflix? Phone data?

I suggest using some sort of a spreadsheet to do this. It can be easy to scroll through a long list of charges and think “I’m not spending too much at the cafe next to work.” But, when you enter it into a spreadsheet, you suddenly realize “not too much” is $60 a month. Yeow! I used a basic spreadsheet at the beginning with broad income and expense categories. I’ve since added more detail with separate columns to tally all groceries, baby expenses, restaurants and home expenses to get a better idea of where our money was really going.

Create your budget.

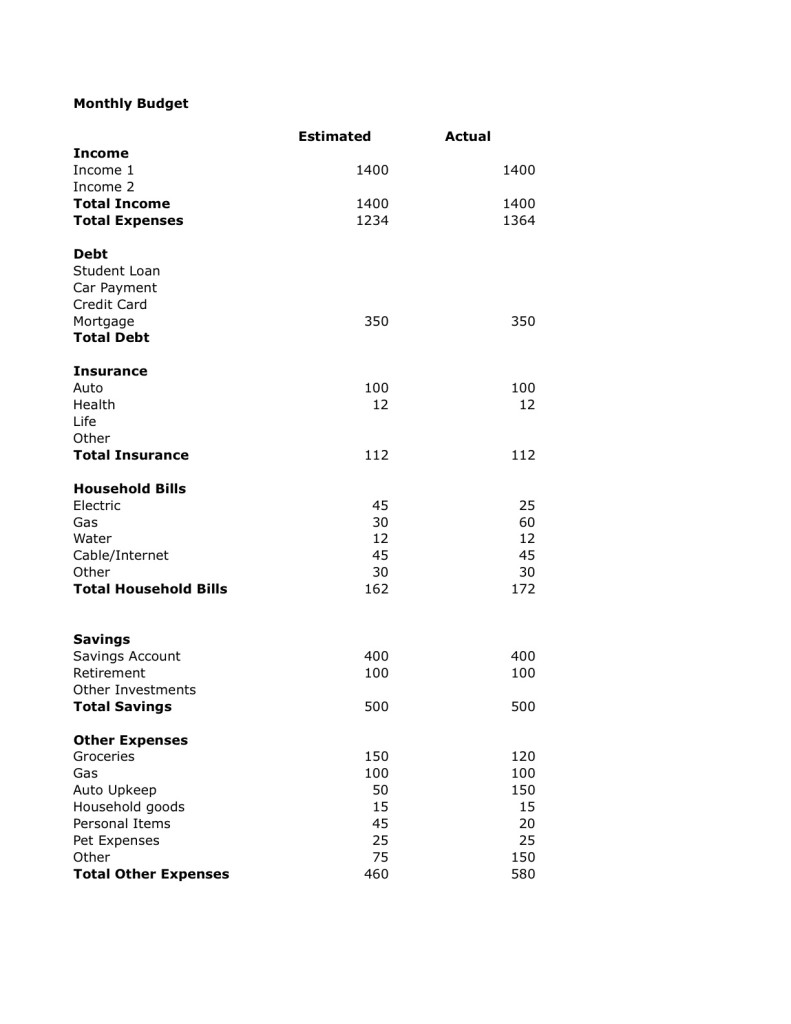

Now that you know where your money is currently going, you can figure out where you actually want it to go! This will be incredibly personal, as it depends on your family’s financial goals. Maybe you are trying to figure out how to pay off those student loans. Or you’d like to ensure that your family can be successful with one income instead of two. You may find that you are having trouble meeting all your financial needs each month, and your goal is to cut your overall spending? Maybe you’ll find that you’re spending $600 a month on food, and you realize that it is time to start some meal planning to cut that number? Maybe you realize that too many dollars are going to entertainment and not enough is being funneled into retirement? The following is a sample budget from my early days. I wasn’t making much as a first year teacher, but I wasn’t spending much as a single renter with roommates.

Give your budget regular TLC.

We sit down each month and plug all of our expenses into a monthly spreadsheet. This allows us to keep track of our spending from month to month and hold ourselves accountable. Some months, we have additional charges that we don’t always directly account for. Like a tire rotation or an unexpected house repair or our annual HOA dues. Sometimes, we might get additional income, from, say, a tax return. Since these early days, we’ve been able to better predict the special budgetary items we need to add for each month. Christmas presents in December. Taxes in April. Giving your budget the attention it needs will help you to stay accountable to your goals, fine tune your expectations, and eventually cease to worry about that moment at the end of the month when your bills come due!

Stick to it.

Boy, this can be tough! Especially when things like post-season Royals tickets feel like a necessity! Sometimes, sticking to your budget might require that you say “no” to buying those tickets or buying the Kirkland brand boots instead of the name brand Uggs or making coffee at home in order to save $100 a month. Change your language from “I can’t afford this” to “this is not a priority for my family.” It is more important for us to put that extra $100 into savings and watch the boys in blue from home. Even if it is a tough call to make.